2018 Year In Review

Wow what a year! We see that you survived it which is more than can be said for several F&B businesses during the past 12 months. In business ‘One simply must understand history in order to not repeat the same mistakes all over again’; so here are some bits and pieces that sure got our attention…

January

Big Hangovers!

The year began with a ‘lump of coal’ hangover from 2017 for a number of franchisors but especially the embroiling Domino’s [ASX: DMP] and Retail Food Group [ASX: RFG] (Australia’s largest multi-brand retail food franchisor) which was the subject of a scathing Fairfax Media expose in the previous month.

February

Clever Accounting? (Australia)

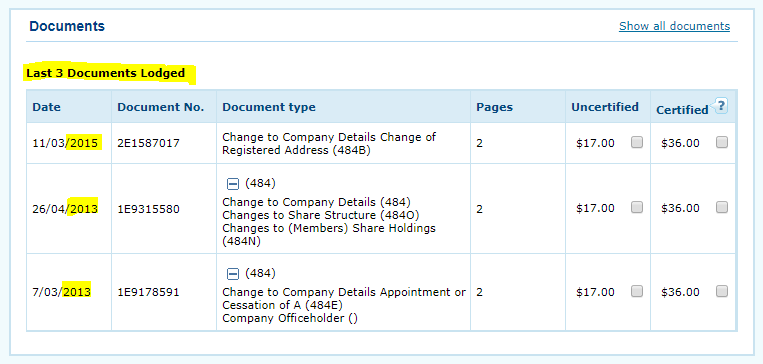

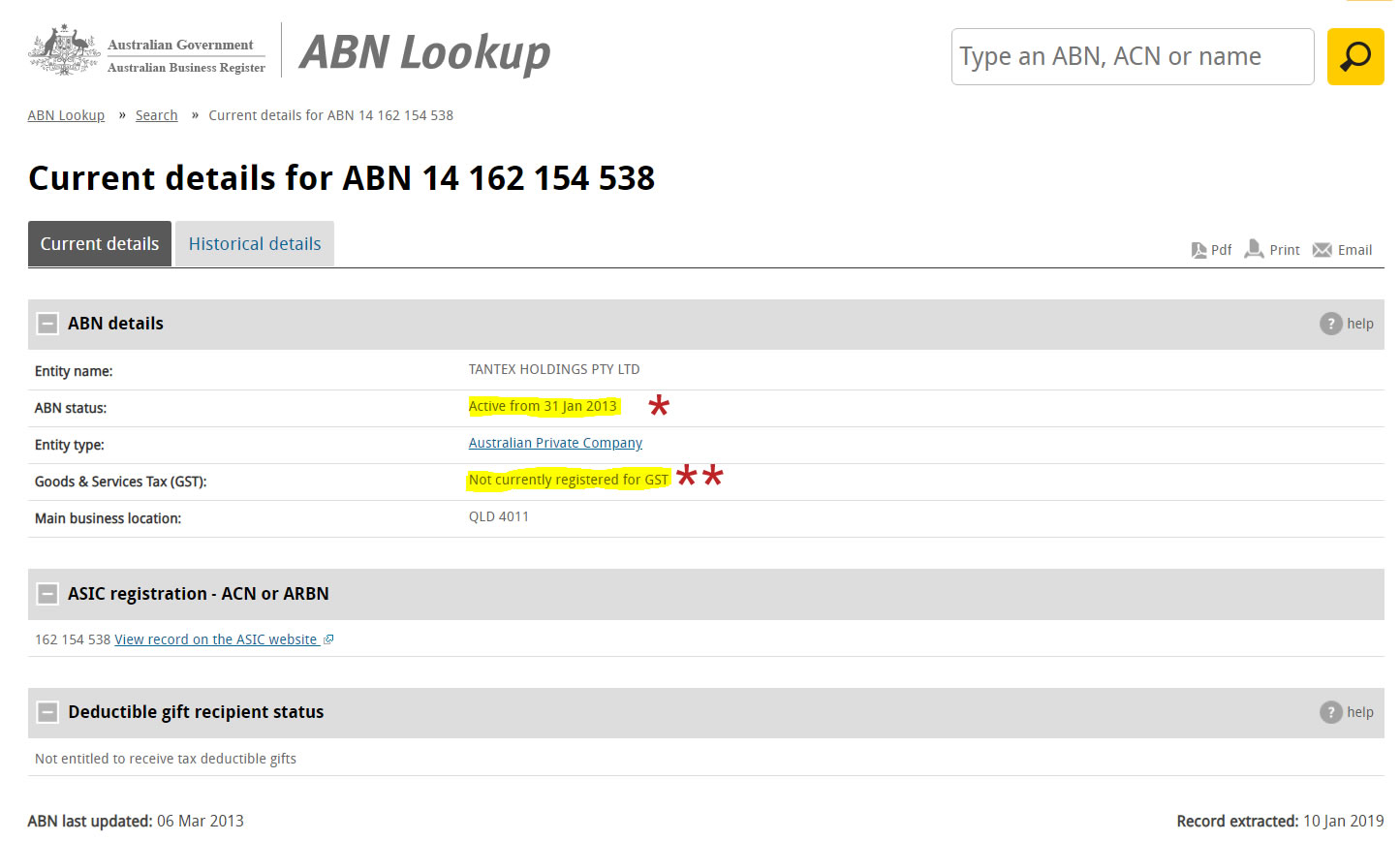

Retail Food Group [ASX: RFG] announced new Master Franchise Agreements for the United Kingdom in connection with the Crust Gourmet Pizza and Donut King Brand Systems, however this left circa $22.0m to be included in RFG’s full year results for FY18, but not for 1H18. Mr Richard Hinson assumed the newly created role of Chief Executive for the public company and the firm Bannister Law, announced its investigation into a possible shareholder class-action RFG said it was “expanding the scope of its investigations” to explore the relationship between company and its franchisees.

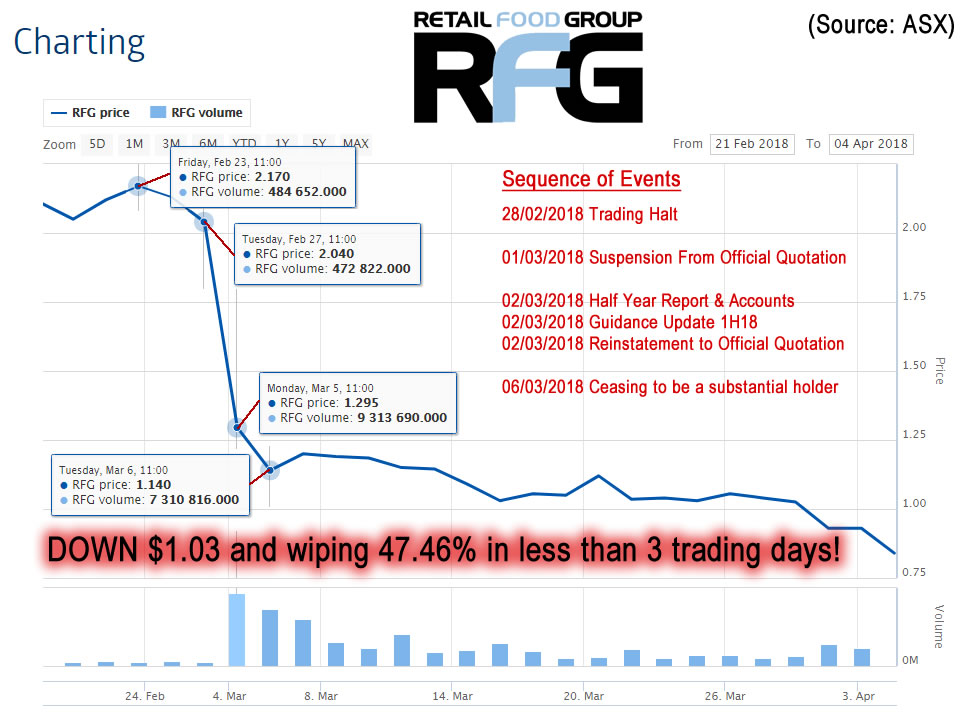

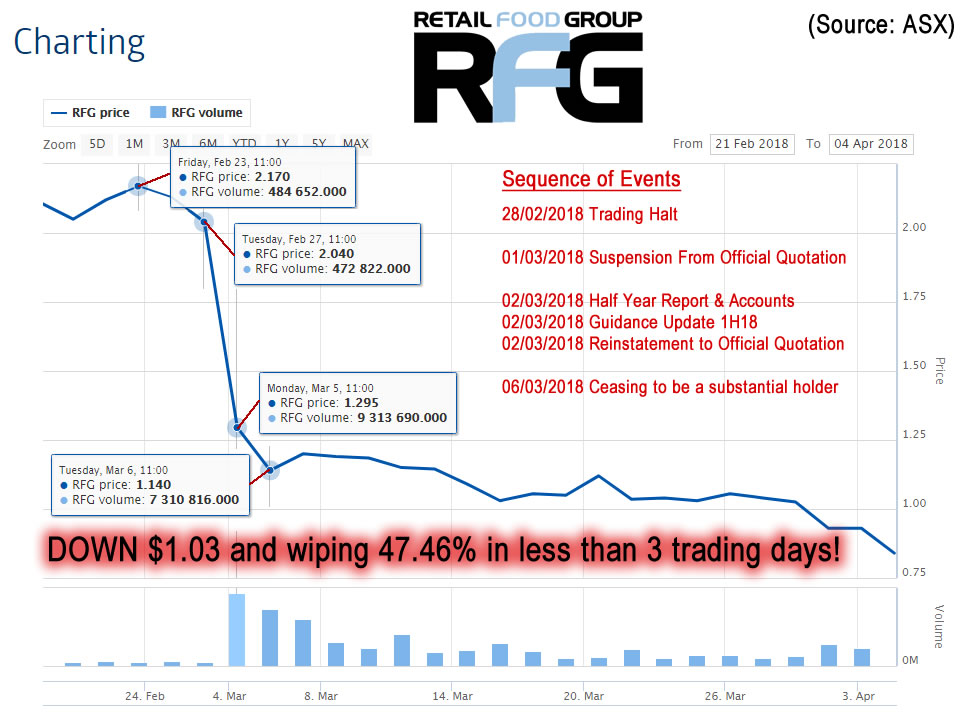

The Trading Halt Session State, at the request of the Company, pending the release of an announcement by the company caused a lot of investor concern. The aftermath was a free-fall in the share price shedding 75c in just a week. This may not sound like a lot, but when your share price sits at $2.17 closing the week on Friday 23rd Feb, then drops over the weekend to sit at $2.04 by Tuesday and then ‘freefall‘ during the halt to re-open at $1.295 Mon 5th March and drop further the following day to close out at $1.14 Tuesday 6th March 2018; then you know there is trouble with a drop of $1.03 off your share price wiping a massive 47.46% of the value of your company

March

Cuban Revolution comes to Manila (Philippines)

Filipinos got a taste for Cuban cuisine with the launch of new Caribbean themed restaurant called Cuba Libre as the latest concept from the Tasteless Food Group. The regulars of the trendy and fashionable Bonifacio Global City (BGC) district of Manila flocked to the up-market version of a traditional Cuban Cantina style eatery, which is located in Serendra.

Pinoy palates were delighted with the familiar flavour profiles and the similarities between the cuisines. Both island nations have large Spanish influences when it comes to underlying culture and food; but the Cuba Libre comes with sprinkles of a secret ingredient – a generous sprinkle of Créole.

Franchise Industry Inquiry (Australia)

The Commonwealth Govt in Australia launched an inquiry into the operation and effectiveness of the Franchising Code of Conduct, after several years of the industry being plagued by poor corporate behaviours and coming to the attention of various regulators for non-compliances and under payment of entitlements to staff.

According to the Franchise Council of Australia, franchises particularly in the F&B space employ a lot of people. Approximately 79,000 operating franchises in Australia employ more than 470,000 direct employees. Over the past few years there have been a string of scandals engulfing franchises, including retailers 7-Eleven and Caltex, businesses under the RFG stable of brands, Domino’s, and Hungry Jacks.

April

Double Blow (Philippines)

Just days after the sudden cancellation of Madrid Fusion Manila (MFM) 2018 was announced, the organizers of the World Street Food Congress (WSFC) said that their event to promote food culture would also not go ahead in 2018. In a double blow to the food industry in the Philippines, the Tourism Board cancelled the annual festival stating that the event which kicked off in 2013 and is organized by Makansutra, a Singapore-based company, will not proceed in 2018.

Pas Plus to Veggie Burgers (France)

France’s Federal Parliament passed new legislation banning various words traditionally used to describe meat as descriptors for vegetarian food. The bold move means that words like steak, sausage, burger and bacon are now banned from being used to describe food products that do not contain meat. Due to the ban descriptors of vegan food products such as “veggie burger”, “veggie sausage” and “vegetarian bacon” are illegal in France and offenders will now face fines of up the equivalent of a whopping €300,000.

May

Impossible Burger Debuts (Hong Kong)

Hong Kong became the first city outside the United States to serve the Impossible Burger, in almost defiance to the above story about the new French legislation, in quite the push-back to the Veggie v’s Meat war food battle. The plant-based burger pattie that apparently tastes – and bleeds – like beef has been touted a Silicon Valley style disruptor that will change the multi-billion-dollar market for beef.

Famous burger restaurant Beef & Liberty dished out the Impossible Thai Style Burger at a HK$135 price tag, chilli, coriander, mint, basil, spring onion, soya mayonnaise, crispy shallots and garlic. Diners can pair this with the Impossible Chilli Cheese Fries, which is served with chili, cheddar cheese, spring onion and sour cream over fries for an extra HK$62. At these prices we suggest that a takeover of the Beef market is also impossible.

June

End of FY Woes Continue (Australia)

Embattled Retail Food Group [ASX: RFG] made an expected statement to the market to close off the Australian financial year that lenders have agreed to waive testing of the financial covenants under the Company’s senior debt facilities with respect to the period ending 30 June 2018. The market seems to see this as a very temporary reprieve of the inevitable spiral that followed.

End of an Era

After four decades of visionary leadership, Howard Schultz is finally bidding farewell to his greatest love – Starbucks. Schultz, who re-imagined the Italian coffeehouse tradition in America and redefined the role and responsibility of a publicly-held company, announces his departure as executive chairman of Starbucks. Schultz, who will be honoured as chairman emeritus, tells over 2 million past and present partners (employees), “We did it together, by balancing profitability and social conscience”

Schultz’s stewardship of the Starbucks brand and business delivers 21,000% price appreciation for shareholders since its 1992 Initial Public Offering leaving a healthy legacy of growth from the original 11 stores, to now more than 28,000 stores in 77 countries.

July

50th Drive-thru for the Giraffe (Australia)

Franchisees Joanne and Paul Brierley opened their second store as a Drive-thru instead of the traditional café format. This style of store is the fastest area of growth in the Zarraffa’s Coffee business and the 50th Drive-thru for the franchise in Australia.

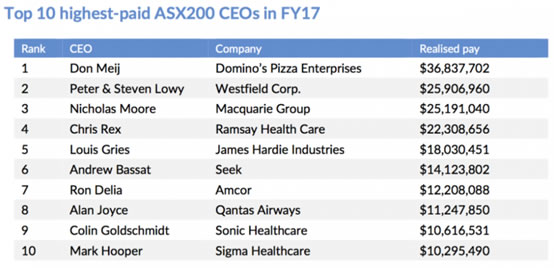

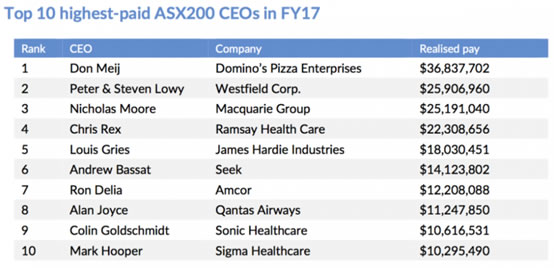

Unreal Pay (Australia)

The big cheese at Domino’s [ASX: DMP], Don Meij was paid a salary package of an unreal $36.8 million last year! That works out to be about 670 times the average F&B worker with a full-time job in Australia.

It is also 3.275088305765102 times the pay of Qantas [ASX: QAN] boss Alan Joyce despite the Airline having a Market capitalisation of $9.31B some $5.79B bigger than the Pizza business in which investors have been doing their dough, watching the share price drop more than $15.80 in the past 12 months.

Ironically, in June Don Meij told a at the Senate inquiry into the franchising sector, (which was called partly in response to allegations of widespread wage fraud and visa scams at Domino’s stores), that he can’t guarantee that no worker at its 733 franchised stores is being underpaid, despite being updated on their sales every 15 seconds. Don Meij said “Payroll is complicated”.

August

Strategy to Grow Coffee (Thailand)

Central Food Retail Group [Thailand] create a new Coffee Division to gain greater control and the strengthen the licenced Segafredo Zanetti marque and fledgling but owned Coffee Arigato brands, which are primarily housed within the Central Group’s Tops Supermarket and Family Mart branded outlets. The new division of the company is expected to bring some growth and changes to these brands as the Thai coffee market gains further traction into what is expected to become a ฿25Billion growth up to 2025.

Whitbread Drops Coffee Business (UK)

Coca Cola struck a deal with Whitbread [LON: WTB] and bought Costa Coffee Britain’s largest coffee chain for over £3.9 Billion in a surprise move that puts Starbucks [NASDAQ: SBUX] on notice. Coke’s entry into the coffee business (once the final deal closes mid 2019) will be the takeover of more than 3,800 stores, with nearly 2500 locations in the UK and 1,415 others around the globe.

September

The Best of Bangkok (Thailand)

BK Restaurant Week 2018 kicked off in Bangkok to celebrate world class dining experiences across more than 60 participating venues over 16 days of gastronomic celebration for an amazing fixed price of ฿1,000++ per person for 3 courses. The 17th year of the event was a roaring success and reflected the growing sophistication of the dining opportunities within this key Asian market.

Bo is the Beau of Netflix (Thailand)

David Gelb’s celebrated television program Chef’s Table returned for its fifth season on Neflix to the delight of foodies everywhere. This time around, the show which profiles a different world-renowned chef each episode, included Chef Duangporn “Bo” Songvisava of Bo.Lan in Bangkok Thailand. Since 2009, Chef Bo and her husband Dylan Jones have constantly pushed Thai fine dining to uncompromising extremes at their Bo.lan restaurant and this has been rewarded by international recognition in the popular tv show.

October

Green Subs (Australia)

DownUnder’s largest quick service restaurant Subway [Subway Systems Australia Pty. Ltd.] which has licensed more than 1,400 restaurants across the country, announced that it will be eliminating the use of plastic bags from its stores Australia wide. The purge of plastic bags is in addition to the use of sandwich baskets for dine-in customers as opposed to having a sandwich wrapped. The ‘green’ strategy should remove 76 tonnes of plastic from its waste stream annually in Australia.

Kiwi Takeover (New Zeland)

New Zealand’s Restaurant Brands [NZE: RBD] has acquired Pacific Island Restaurants, the sole Taco Bell and Pizza Hut franchise in Hawaii.

The acquisition occurred for USD $105 million. The Pacific Islands Restaurants network includes 37 Taco Bell stores and 25 Pizza Hut outlets.

Prior to the acquisition, Restaurant Brands had 215 takeaway chains across New Zealand and Australia, including KFC, Pizza Hut, Starbucks and Carl’s Jr stores.

November

New Captain – Ship Still Sinking (Australia)

The recently appointed non-executive Director and Chairman of Retail Food Group [ASX: RFG], Mr Peter George, has assumed the role of Executive Chairman, effective immediately. George was recruited to the Board as a turnaround specialist with a successful 30-year career as a senior executive and non-executive Director, including extensive professional experience of corporate turnarounds. The more than $1/2 Million appointment made little or no difference to the share price or market confidence, with Richard Hinson as Group Chief Executive Officer of the company standing down days later on the 3rd of December.

Butchers Get The Chop! (UK)

Cranshaw, a chain of butcher’s shops, has closed 35 stores and a distribution centre, the latest in a line of UK High Street retailers running closing down, giving 350 workers the chop. Administrators from EY are trying to sell the business while 19 stores continue to trade (nine of them factory stores). The collapse of the company came after several years of financial losses. The company joins a growing list of British retailers forced to seek protection from creditors after being hit hard by competition from online shopping platforms and a rise in costs from the pound’s Brexit-induced weakness. The forecast for anyone working in the retail industry is hope for the best but prepare for the worst anyway.

December

Fire Sales Predicted (Australia)

Retail Food Group [ASX: RFG] lenders have agreed to waive testing of the financial covenants under the Company’s senior debt facilities with respect to the period ending 31 December 2018, whilst the Board announces that it remains focused on the Company’s balance sheet position and continues to assess a range of alternatives to reduce balance sheet leverage, including potential asset sales first flagged more than a year before.

Franchisee Sues For Lost Dough

Domino’s franchisee Tim Yervantian is looking for AU$6 million as compensation for losses and damages. He said that he was promised that his first store would generate AU$100,000 a week, but instead got AU$34,000. The company is formally stating that it will strongly defend all legal actions and claims against them. A number of disgruntled franchisees have been speaking out during the year and are seeking redress for perceived and alleged misconduct by the Franchisor.

The Death of About Life (Australia)

The independent Organic food retailer About Life has been placed into voluntary administration after a series of legal disputes with suppliers over the last 18 months. The 22-year-old business was expanding up until 2yrs ago, replacing Thomas Dux stores in Sydney and Melbourne, but things appear to have gone awry with over $200,000 in legal claims levied against the business by suppliers and others.

Summary

It was a rugged year for most and a few clear winners emerged. Some had a foot in each column eg Domino’s but most continued with passion and care to steer past the speed-humps and bollards of business life. Overall the year was interesting and taught a few lessons to those who choose to be students of life.

Those businesses who have built a plan for 2019 and used 2018 to plan and consolidate in preparation for the tightening market conditions expected in global markets from 2019 will be advantaged by being prepared and by adopting strategic uses of technology to enhance customer experiences rather than decline head-counts for accounting purposes only.

There were clear winners and losers this past year and even a couple who straddled both columns like a child trying to convince a shopping mall Santa that they were good all year.

Winners

Milestones and Flagstones

Soul Origin took 7yrs to reach the 100-store mark and Chatime, which entered Australia in 2009, reached the same milestone before the year closed. Domino’s [ASX: DMP] also grew their footprint of outlets when they opened their 700th Australian store in Flagstone near Jimboomba, south-west of Brisbane.

On an individual basis, the biggest winner of all has to be Don Meij CEO of Domino’s with annual earnings of a staggering $36,837,702! Based on the average price of a pizza made by his franchise that is a massive 2,738,862 pizzas, a bottle of drink and a garlic bread!

Losers

The year also saw a select group of brands entering voluntary administration for various reasons, each with different fates. Franchise Retail Brands was the first big one to do so 2018, which was then later followed by Zumbo Patisserie, foodora, and also Max Brenner Australia, which has reportedly been sold to Roy Mustaca, the owner of United Cinemas. In contrast, we also saw brands like Doughnut Time making a comeback after liquidating and being bought by new owner Peter Andros.

Domino’s [ASX: DMP] woes and scrutiny that plagued them and their share price during 2018 are set to continue, with various legal actions still before the Courts…

Retail Food Group [ASX: RFG] got absolutely flogged on Stock market in 2018 and the only people winning seemed to be those leaving the company in a hurry taking the spoils with them, whilst financiers and franchisees alike are left to wonder about the future of their investments and businesses. #DeadDuckWalking ?

At the moment we are taking friendly bets at to when the regulators and/or liquidators will step in to halt and or prevent insolvent trading by RFG. Will they be able to last out the year? Modelling on the previous 12 months would suggest not!

Best of luck and planning and passion to you in 2019!